Learn what is an impression on Pinterest & its impact on your account. Dive into our ultimate guide for insights...

Shorts Generator AI – Instant TikTok, Instagram and YouTube videos from your ideas. Drop a link or an idea and the AI-powered YouTube Shorts generator AI does the rest — no skills necessary.

videos created with ShortsGenerator.ai

increase in engagement with AI suggestions

creators using ShortsGenerator.ai

create short ai videos free, 2 shorts. ai, 2hort.ia, 2shot ai, auto create shorts from youtube video

Experience how ShortsGenerator.ai transforms ideas into stunning, high-quality films in seconds. Discover the creativity, efficiency, and uniqueness it brings to your content.. Then post schedule your content across social media.

shortsgenerator.ai youtube clip, ai youtube shorts maker, viral ai video generator, faceless video ai generator free without watermark, youtube shorts generator free ai, ai faceless video generator free, ai video generator youtube shorts, ai video shorts maker, create shorts with ai, shorts video maker ai, youtube shorts maker ai free without watermark, ai website to create youtube shorts, create shorts from youtube video ai, create shorts from youtube video ai free, create shorts with ai free, generate shorts using ai, shortx ai, youtube short video generator ai, ai shorts editor, ai youtube short video generator, ai youtube shorts maker free, edit shorts with ai, faceless ai video generator free, free ai for youtube shorts, short video generator ai, shorts making ai free, youtube shorts video maker ai, 2 shorts ai, ai art generator tiktok, ai create shorts from youtube video, ai for short videos, ai generated shorts video, ai link generator, ai photo generator tiktok, ai picture generator tiktok, ai short video generator from youtube, ai shorts generator from youtube video, ai that creates short videos, ai that turns videos into shorts, ai to create youtube shorts, ai to make shorts, ai to make shorts from long videos free, ai viral video maker, ai youtube shorts video maker, autoshortai, best ai video generator for youtube shorts, best free ai for tiktok content ideas, best free ai youtube shorts generator, clip short ai gratis, create ai short video, create ai video for tiktok, create short video ai, create viral videos with ai free, faceless ai video creator, fast shorts ai, free faceless video generator, free faceless video generator ai, generate short video ai, generate shorts from youtube video ai, generate shorts from youtube video ai free, make short video with ai, make viral shorts ai, make youtube shorts with ai free, short 2 ai, short ai video free, short ai video generator free, short for generator, short making ai, short video ia, shortsplot ai, shortsplot.ai, shortspro.ai, text to video ai for youtube shorts, tiktok ai video generator free, tiktok video ai generator free, tiktok video generator ai free, video to tiktok ai, video to viral shorts ai, video to youtube shorts converter ai, video.ai shorts, videos to shorts ai, viral link generator, youtube ai shorts maker, youtube link generator short, youtube short generator ai free, youtube shorts ai free, youtube shorts link generator, youtube shorts maker ai free, youtube shorts making ai free, youtube to shorts ai free, youtube video to shorts converter ai free without watermark, yt shorts creator ai, yt video to shorts ai

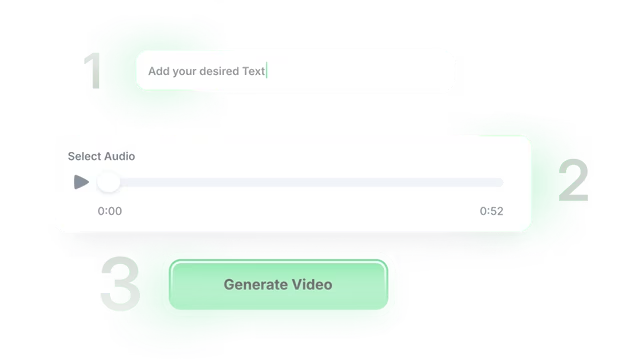

You don’t need any video editing experience. Just provide your text or a link, and let shortsgenerator o the rest.

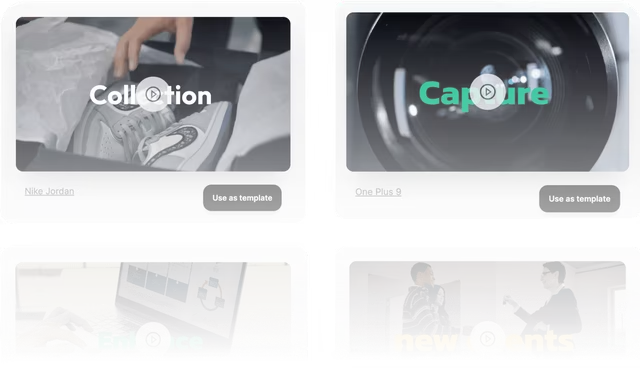

Start with our AI Video templates to convert your ideas into videos with revid.ai.

Impress your audience with stunning AI-generated visuals. Choose from multiple resolutions, and quality exports with precise frame rate control.

Pick the right tool, provides your input, and you’ll create a video ai youtube shorts generator in no time – customize it however you want.

yt short generator

Convert your YouTube video into a short vertical. youtube clip maker

Need high-performing shorts? Try our AI TikTok video generator designed for creators and brands.

short2ai Make engaging videos from your podcasts, interviews, or any audio content. ai pixar generator

See how we stack up in this faceless video automation comparison.

ShortsGenerator.ai is your secret weapon for creating irresistible vertical videos in a snap. Our AI-powered platform analyzes millions of viral videos to craft scripts and generate stunning visuals that are optimized for maximum impact. Whether you're creating product demos, explainer videos, or social media ads, ShortsGenerator.ai helps you produce content that consistently captivates your audience.

Before integrating any automation tools into your content workflow, take a moment to review this breakdown of YouTube automation legality and best practices.

Absolutely! ShortsGenerator.ai is designed with creators like you in mind. Our intuitive interface and AI-driven tools make it a breeze to produce professional-grade videos, even if you've never edited before. Simply input your text or link, and let our AI work its magic. It's like having a video editing genius at your fingertips! Explore the differences in AI automation in our Synthesia vs InVideo breakdown.

The possibilities are endless! Whether you want to repurpose a blog post, turn a podcast into a video, create a viral TikTok from scratch, or produce engaging product demos and explainer videos, revid.ai has you covered. Our AI can generate scripts from any text or URL, find the perfect viral hooks, and even create videos automatically from your favorite content sources. Need a smoother publishing experience? Explore this Vadoo AI alternative.

While our AI is incredibly powerful, you always remain in the driver's seat. ShortsGenerator.ai provides a foundation of high-quality, engaging content that you can then customize to your heart's content. From adding a professional sounding voice-over and branding elements to fine-tuning the visuals and pacing, our platform empowers you to create videos that are authentically yours.See our Crayo AI vs AutoShorts comparison

ShortsGenerator.ai is your partner in audience growth and business success. Our AI is trained on millions of viral videos, so it knows exactly what makes content irresistible. From attention-grabbing hooks to mesmerizing visuals, ShortsGenerator.ai helps you create videos that demand to be watched and shared. Our users have reported an average of 600% increase in video engagement, 200% monthly growth in their businesses, and a staggering 10,000+ videos created in just 8 minutes each. Rest assured, your content creation success is our #1 incentive. Discover how much creators are really making with YouTube Shorts CPM insights.

youtube shorts ai generator is your partner in audience growth and business success. create viral shorts in seconds. with ai viral generator Trained on millions of viral videos, our AI knows exactly how to generate engaging Shorts that capture attention and spark shares. Whether you're exploring tools like AutoShorts.ai, Shorts Pilot AI, or Shortspeak AI, ShortsGenerator stands out as a powerful faceless Shorts generator that delivers real results. From attention-grabbing hooks to mesmerizing visuals, we help creators—from YouTube to TikTok—build a loyal audience fast. Our platform rivals any auto Shorts generator free or TikTok Shorts creator, producing over 10,000+ videos that take just 8 minutes each. Many users report 600% increases in engagement and 200% monthly business growth. With text to video AI free tools and our cutting-edge AI video to Shorts generator, your content creation success is truly our top priority. eed fresh visuals for your videos? Explore this Crayo AI alternative for quick, creative assets.

ShortsGenerator.ai is like having a full video production team at your beck and call, 24/7. Our AI handles the heavy lifting, from researching viral trends to generating scripts and visuals. What used to take hours or even days can now be accomplished in minutes. And with our Automations feature, you can even set ShortsGenerator.ai to create videos for you on autopilot. Post Bridge.

Our team of video experts and AI engineers are constantly pushing the boundaries of what's possible. We stay on top of the latest trends, platform updates, and best practices to ensure that remains the cutting-edge tool for creating irresistible videos. youtube short ai generator As the digital landscape evolves, so does giving you a competitive edge in your content creation game. Want to launch faceless content in seconds? Check out our AI Shorts creator for plug-and-play videos.

While there's no free version of ShortsGenerator.ai, we do offer a suite of AI-powered mini-tools that you can take for a spin. Now auto shorts ai can get a taste of the magic by creating clips from YouTube videos, generating AI avatar videos, and more. And when you're ready to unleash the full power of ShortsGenerator.ai, our flexible pricing plans make it easy to find the perfect fit for your needs and budget. Trust us, once you experience the ShortsGenerator.ai difference, you'll wonder how you ever created content without. Not a fan of the interface? Try our Crayo AI alternative for faster faceless video production. Before you choose a platform, read this Autoshorts vs InVideo breakdown.

short2ai is an AI YouTube short maker that turns text or topic ideas into ready-to-publish videos in minutes. Using advanced automation, this short maker AI handles everything—from script generation to editing—so you can focus on scaling your content. Post Bridge Tool - It functions as an AI short generator, ideal for creators who want to stay consistent without the hassle of filming. With features like auto short AI, it streamlines the entire process, delivering scroll-stopping videos optimized for YouTube. Whether you're a brand or a solo creator, ShortsGenerator.ai helps you produce AI-generated viral videos that are built to capture attention and grow your audience. Looking for a better workflow? This AutoShorts AI alternative offers smarter automation and speed. Wondering how creators earn? Check this breakdown of Instagram payouts for viral videos.

Learn what is an impression on Pinterest & its impact on your account. Dive into our ultimate guide for insights...

Discover the best tech channel name ideas for YouTube success. Get inspired by our list of creative and catchy names...

Looking for dog YouTube channel ideas? Check our listicle for creative ideas to captivate your audience.

Find out how many videos should I upload on YouTube to get 1,000 subscribers. Step-by-step guide to growing your YouTube...

Discover the best animation YouTube channel ideas that actually work for creators. Get inspired and grow your audience with these...

Discover What Is the Difference Between Pinterest and Pinterest Lite? and choose the best platform for your needs.

Learn How to Avoid Copyright on Pinterest with our step-by-step guide. Discover the best practices to safely share content.

Is Pinterest Still Relevant in 2025? Our trend analysis dives into the latest data and insights.

Get to the bottom of 'Why Are My Pinterest Monthly Views Decreasing' and regain your Pinterest presence with our step-by-step...

Discover powerful autoshorts ai alternatives for effortless video summarization and editing. Enhance your content with AI-driven visual effects and streamline...

Discover powerful autoshorts ai alternatives for effortless video summarization and editing. Enhance your content with AI-driven visual effects and streamline...

Discover powerful autoshorts ai alternatives for effortless video summarization and editing. Enhance your content with AI-driven visual effects and streamline...

Discover powerful autoshorts ai alternatives for effortless video summarization and editing. Enhance your content with AI-driven visual effects and streamline...

Convert URLs to videos effortlessly with our user-friendly url to video converter. Download, save, and share your favorite online content...

Create stunning videos effortlessly with Quick Video AI. Our powerful tool streamlines the process, letting you produce professional-quality content in...

Discover how to easily trim and download YouTube videos with our step-by-step guide. Learn to use youtube video trim download...

Trim YouTube videos effortlessly with our online YouTube video trimmer. Cut, edit, and create perfect clips in seconds - no...

Easily trim YouTube videos with our user-friendly YT video trimmer. Cut, crop, and splice clips effortlessly. Perfect for content creators...